Is Iron Galaxy a possibility?

If MS buys WB they are getting tons of other AAA studios with it. If MS wants to shore up those areas I’m sure there are more efficient ways of going about it.

I know everyone loves those WB studios, but I just don’t see it. I mean, it is possible, but I doubt it. For Xbox I think WB was an alternative to Bethesda. I doubt they were ever seriously considering buying both. Those WB neogoiations occured before the Bethesda announcement.

FWIW, I think this thread is too focused on fulfilling certain game genres instead we should focus on demographics.

Why buy them tho? Just contract them

They got boomers covered with Solitaire.

So somebody else doesn’t ![]() (if they were making a franchise that they plan to continue, like KI).

(if they were making a franchise that they plan to continue, like KI).

You can develops and build the studio. They can recruit the highest end talent for better games, Iron Galaxy might have trouble with that.

I mean did anybody play Extinction? That was there attempt at making an Attack on Titan game. And it failed……. really bad. Plus I’m sure no one sees a bright future for this none sense.

I say let them beI was so mad when this game got shown off. Not because of the concept, but the fact the folks at Iron Galaxy can clearly do better.

It’s really a shame and I hope they find major success at some point, because if Rumbleverse fails too I doubt they’ll be independent much longer… or potentially even open (I hope that doesn’t become the case).

Couldn’t they be the ones making KI? If so and it comes together nicely, I would like to have them secured early.

If I remember it correct, Iron Galaxy does a shitton of contract and support work. Joining a publisher and focusing on their own projects, should already lead to a significant improvement in terms of output quality.

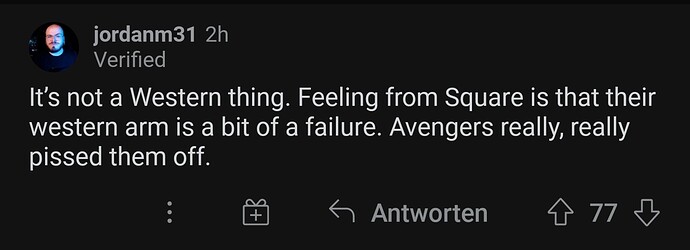

Comment from a VGC journalist regarding the western side of Square Enix.

I know it’s not very likely they are going to sell, but some people here are claiming that we don’t know if Square Enix see’s them as failure.

The crazy thing is though, Avengers failure is entirely on Square Enix’s leadership. They want to see who failed, they need to look in the mirror.

Whats the link ?

IMO Square Enix does by far the most dumb decisions of the big Japanese publishers.

They take a quick buck instead of expanding their audience.

You could also take a look at IOI. They are more successful than ever right after departure from Square.

I could easily name 4-5 examples more.

I’m going to put on my professor hat for a moment and attempt to briefly explain the difference between stock prices (and market cap) and acquisition prices.

The stock price (and therefore the market cap) is the price determined in what economists call the OPMI market - the market for Outside Passive Minority Investors. For the most part, investors in the OPMI market (which is the “normal” stock market) are never going to be insiders, have control of corporate strategy, etc. The OPMI prices reflect these facts. In theory, prices are determined based on the firm’s expected cash flows, risks, and growth.

Acquisitions do not happen in the OPMI market. They occur in the “market for corporate control.” Acquisition prices are also determined by the firm’s current (expected) cash flows, risks, and growth - but they are also affected by potential shifts in strategy enacted by the new parent company and synergies that exist with the new parent company. In short, OPMI prices are largely driven by three factors (cash flow, risk, growth), while acquisition prices are driven by five (the previous three plus “control” and synergies).

Average “control premiums” in most industries are around 40%-50% or so. So, if the market cap of the firm is $6 billion, you would typically expect to pay $8.4 - $9.0 billion to acquire it.

However, the presence of synergies can change the math quite a bit, since it is typical for the target firm and the acquirer to “split” the potential benefit of synergies to some extent.

For example, assume we have a firm with a “stand alone value” of $9 billion (this is it’s acquisition value including the control premium if no synergies are present), but it has a “synergistic value” of $12 billion (meaning it is estimated there are $3 billion of potential synergies between the target firm and the acquiring firm). In this case, negotiations might lead to an acquisition value of $10 billion - meaning the target “claims” $1 billion of the synergy value and the acquiring firm claims $2 billion.

Of course, I am looking at this from a 20,000 foot view. In reality none of these values are easy to estimate and there may be major disagreements on all of them (both within the firms and between the firms). It is also true that most firms enter negotiations with a range of acceptable values. So the target firm may be willing to sell at any price above $9.5 billion and the acquiring firm may be willing to buy at any price up to $11.5 billion. As long as seller’s “floor” and the buyer’s “ceiling” are compatible then a deal can be made through effective negotiating.

Okay, I’m sure that’s long enough. Hopefully that wasn’t too boring. ![]()

Always appreciate your posts

Think of it SE are facing having to fund thier western side for another generation, and gaming is only getting more expensive. Cutting thier losses and offloading to MS is in thier best interest

I think if Forspoken flops, Square will proactively look to dump their Western studios. They’ll have to trim the fat after three consecutive AAA commercial failures and they won’t start at their Japanese division.

This is the same company that is asking above normal expectation on sales record. They can sell 10 millions and still call it underwhelming.

I get a feeling Platinum Games is going to get hit bad from Babylon’s Fall if it fails. That game has gone through development for a while, including boosting fidelity. It looks rough and if it fails, Square won’t be happy and expect blame game.