Originally published at: Are Acquisitions "Good for the industry"? - XboxEra

Waking Up to Change

“You can’t wake up one day and say, ‘Let me build a game studio,’”

Satya Nadella says to Cnet after the gaming world would stir to the news of Microsoft’s industry shattering announcement to acquire Zenimax Media for $7.5 billion. Satya would foreshadow that there would be more to come. Not too far in the distant future, other large players in the industry announce significant deals. EA would agree to purchase both Codemasters and Glu Mobile for a combined $3.3 billion. The Embracer Group agrees to purchase Gearbox Entertainment, mobile developer Easybrain and Aspyr for a combined $2.5 billion. Sony just announced the acquisition of Housemarque and Nixxes, and are suspected to have purchased at least one more.

At the time of this writing, both Embracer and TenCent are raising money to add additional companies to their portfolio. If the number of billions being thrown at gaming companies sounds a little out of the ordinary, that’s because it is. Gaming industry investment reached a new high in 2020 with no signs of slowing down.

In a recent interview with IGN, Phil Spencer volunteered his perspective on game developer acquisitions as a “natural and healthy part of our industry”. Considering that the IGN crew weren’t challenging Microsoft’s buying spree at the time, it would appear Phil was pushing back to a narrative growing elsewhere.

In a March 5th article from Bloomberg, Jason Schreier represented a different point of view regarding the anxiety others have over these buyouts. “An industry dominated by a handful of big companies could eventually lead to creative stagnation and other symptoms of monopolization, like limited choices and higher prices. It’s great to see developers finding financial success, but it’s hard not to be worried about the long-term ramifications for video game fans and makers. By the time we see the results, it may be too late.” If you frequent discussions in gaming forums, then you’ve likely heard these concerns echoed by others.

Creative stagnation, limited choices and higher prices sound like a combination of factors that any fan of the gaming industry should reject but is the gaming industry trending in that direction? How do these buyouts relate to the current trajectory? Let’s take a look.

Creative Stagnation?

“The most limiting aspect to creativity and game design isn’t the hardware. It’s the boardroom.”

(Anonymous ‘AAA’ developer)

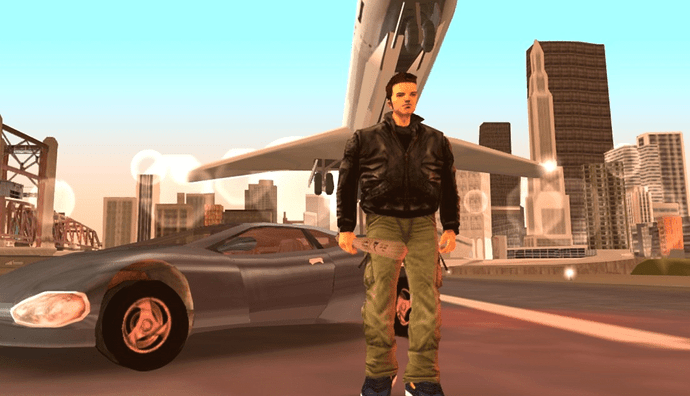

20 years ago, the videogame industry appeared to be in this adolescent stage of self-discovery. Many western developers like Bethesda and Bioware were making their first appearances on consoles, bringing those gamers a type of experience that had never existed there previously. Halo and GTA3 changed the gaming landscape. Half Life 2 and Valve would soon revitalize PC gaming.

We were witnessing the dawn of online gaming and towards the end of that cycle, there was a healthy mix of both single and multiplayer gaming. Why then would popular single player IPs born over the next 2 generations not be able to find life in the last seven years by the industry’s biggest publishers? Why would a studio like Arkane, who made one of the highest rated multiplatform AAA single player games last generation, be rumored to have been on the chopping block prior to Microsoft’s acquisition of Bethesda?

A quick look at the financials show a AAA gaming industry that is thriving all while taking less big chances in the process. In the previous five years, industry leading publishers Activision-Blizzard, EA and Take-Two averaged less than three single player games per publisher, barely more than 1 single player game every other year.

The other two western powerhouses, Warner Bros and Ubisoft were willing to fund single player games however Warner has recently stated they’ll be pivoting to more live service games. Ubisoft has largely relied on three IP’s which have had more than five sequels (Assassin’s Creed, Far Cry and Just Dance) with only one new single player IP in that time. Square recently had their best Western studio, Crystal Dynamics, change direction from the single player games they exceled at to a copy-cat formula Games as a Service title in the Avengers. The data makes it clear that in the AAA space, what’s been good for business and what’s been good for diversity were at odds with each other.

There has been a growing counter-balance to the stagnation of the AAA industry however. When we look at the number of unique developers over the past two generations, the Xbox platform grew from about 600 developers on the Xbox 360 to 2200 on the Xbox One.

This has been a result of significant growth in the independent sector of gaming. Independent developers are able to take more creative risks as a result of lower average development costs. As the industry trends towards cloud development and improved developer tools, the barriers for creative people to bring their visions to life will continue to lower while their output will increase in graphical fidelity. This may explain why many accomplished AAA creatives have left big companies to start new studios in recent years.

In addition, we can’t ignore that the core reason for Microsoft’s acquisition spree was to supply the Xbox Game Pass subscription service with bigger games more frequently. As discussed in our Netflix of Games analysis, bigger games from a diversity of genres, regions and rating classifications are necessary to fulfill the vision of reaching a diverse audience.

Based on a December, 2020 report from Simon-Kucher & Partners which included a survey of 13,000 people in 17 countries, they predict subscription services to become a predominant way that consumers access media much like with music, TV and movies. According to their findings, Simon-Kucher doesn’t expect the gaming subscription market to be a “winner-takes-all” where one company dominates the market. The relevance of this is expanding the subscription market will continue to enhance the environment for more creative risks.

If creative risks were primarily coming from the growing Independent community and have been emboldened by new gaming models, then it would seem disingenuous to equate buyouts of larger studios as a primary threat to the industry’s creativity. This is especially true when considering the apparent loss of appetite to take risks on expensive projects in the traditional AAA gaming paradigm.

Limited Choices?

In March of 2001, Sega would announce they were bowing out of the console business leaving the AAA gaming space with two platforms until Microsoft replaced Sega later that year. Fast forward twenty years and we have not three but rather eight platforms which are either established or have money to fight for position between Microsoft, Sony, Nintendo, Valve, Apple, Google, Epic and Amazon.

These companies will need to provide unique values relative to the current market leaders in order to survive. The industry has moved from a couple hundred developers to thousands in two decades. As 5G streaming is expected to create more engagement opportunities, gaming PCs continue to grow at a strong pace and console manufacturers offer more price points, the consumer has options to play more games from more developers on more types of devices than at any other time in the history of the industry.

As the technology matures, the onus on platform holders will only become magnified to meet their customers where they prefer to game. We’ve seen recent evidence as Microsoft now publishes all their 1st party content on PC and Sony is trending towards more PC support as well. As long as the trend of developers continues to out-pace the trend of acquisitions and platform holders to become more accessible, consumer options don’t show signs of reducing unless we focus on a narrow segment of consumers who impose limitations on themselves over platform preference.

Higher Prices?

Consumer options extend beyond the hardware of storefronts. Pricing models are more diverse than at any point in history. Digital distribution has allowed developers to diversify and innovate in how they sell their content. Today’s biggest games can be accessed for free. While the high end of traditional games has risen to $70 in the US (and more in other regions), there’s also a number of high quality games that covers the spectrum of prices points. An example is a game like Hades, nominated for Game of the Year in 2020, priced at $25. The growing number of developers making high quality games will continue to give gaming consumers options within the traditional model alone.

Subscription models are still in their infancy yet already offer a value proposition to consumers unimaginable only five years ago. Game Pass offers hundreds of games, including many new releases, for $10 a month. Recently Sony has reduced the cost of their subscription service, PS Now, while simultaneously increase the quality of their offerings for PS Plus in light of this competition. If the price of the traditional AAA game is too much, we have a subscription for you.

Hardware is still an expensive consideration that gamers need to consider at least every seven to eight years. In an industry like gaming where content and services is where the profits are generated, the revenue from console sales was never the focus. Hardware cost has always been a barrier. The competition for platform holders is the accessibility of their ecosystem. That’s why even when competition was low, platform holders continued to sell their hardware at or below cost. As internet quality progresses worldwide, we should expect to see more consumers feel no dedicated gaming hardware is a viable gaming option .

Expanding Industries are Healthy Industries

What we’re seeing today is an expanding industry. Most projections have gaming growing substantially over the next six years because advancements in technology are increasing it’s reach. This growth has created more opportunity and therefore more players looking to reap the benefits. Rather than buyouts being a leading indicator of negative trends for consumers and developers, it’s a byproduct of increased demand and opportunity. As technology lowers the walls between gamers and creators, the spotlight on games shines brighter. If the impact of hardware gets reduced and it’s easier for consumers to move around, then naturally the value of the creatives who manage and build games swells.

“Starting a new studio is a very risky proposition.” Spencer continues to say to the IGN crew. “And if a team actually takes the risk of starting a new company, starting a studio, building that over years, building value in that, to say that they shouldn’t sell, I think is just short-sighted.” He goes on to explain that being rewarded for “creating value” is what continues the cycle of new companies deciding to take these risks. Today it’s a seller’s market and many business owners are looking to be rewarded for the value they helped create.

While we may continue to wake up to more studio purchases from the industries big fish, there doesn’t appear to be signs that we will wake up to an uncompetitive or uncompelling industry anytime soon – no matter what armchair analysts in internet forums tell you.